Synthesis: Are We Next?

Peter Turchin made a prediction in 2010 that got him labeled a crank. The Russian-American complexity scientist had been feeding historical data—centuries of it, from dozens of societies—into mathematical models. The models kept spitting out the same answer: the United States was entering a "turbulent twenties." Peak instability around 2020. Elevated risk of political violence. Social fragmentation. The patterns from ancient Rome, imperial China, medieval France—they were all converging on America's near future.

When COVID hit, protests erupted, and an insurrection stormed the Capitol, Turchin's prediction looked less cranky.

I've spent seven articles walking you through the science of collapse—Tainter's diminishing returns, Diamond's environmental factors, Hall's energy analysis, the Seshat database, resilience theory, historical case studies. Now comes the part you've been waiting for or dreading: What do the frameworks say about us?

Let me be clear about what I'm doing here. I'm not predicting collapse. I'm applying the analytical tools we've developed to our current situation. Think of it as a systems diagnostic. You might not like what the gauges show.

The Complexity Diagnosis

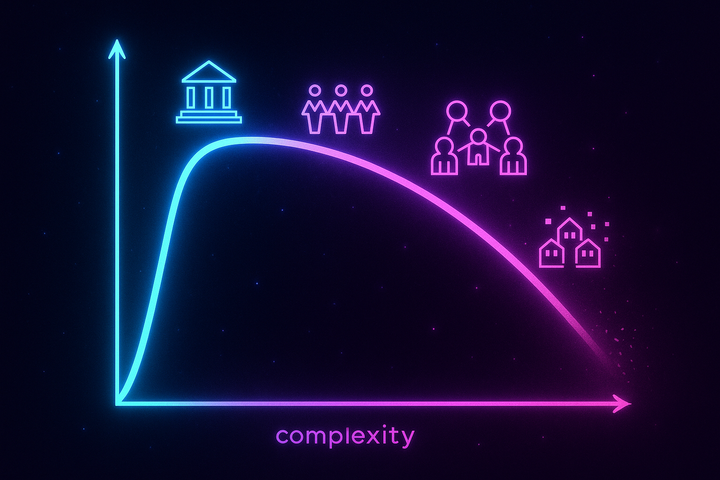

Tainter's framework asks a simple question: Are we getting less return on more complexity?

Exhibit A: The credentialing arms race. In 1970, about 25% of middle-class jobs required a bachelor's degree. Today it's over 60%. But the jobs themselves often haven't changed—same tasks, now requiring four more years of education and tens of thousands in debt. We're paying more for the same position in society. Diminishing returns, definitionally.

Exhibit B: The regulatory ratchet. The Federal Register—the compendium of U.S. federal regulations—ran 2,620 pages in 1936. Today it exceeds 90,000. Each regulation exists because it solved a problem. Almost none get removed when conditions change. The complexity accumulates, the maintenance cost compounds, and somewhere a small business owner spends 40% of their time on compliance that produces nothing.

Exhibit C: Healthcare—the perfect case study. The U.S. spends nearly 20% of GDP on healthcare, more administrative complexity than any society in history has devoted to keeping people alive. The outcomes? Life expectancy ranks 46th globally. We've built the most elaborate medical bureaucracy ever conceived, and it produces middling results at astronomical cost. This is diminishing returns rendered in spreadsheets.

Exhibit D: Infrastructure decay. The American Society of Civil Engineers grades U.S. infrastructure at C-minus. Bridges are structurally deficient. Water pipes leak. The electrical grid strains. We can't maintain the complexity we've already built, let alone expand it. The Romans had this problem in the fourth century—the roads were still there, but nobody could afford to fix them.

The counterargument is digital technology: maybe information systems have increasing returns that change the whole calculus. Maybe the marginal cost of distributing information approaches zero. Maybe AI creates capabilities that offset complexity costs.

Maybe. The jury's out. But notice what we're doing: we're hoping a new energy source (in this case, computational energy) will extend the curve. That's the same hope every mature civilization has had. Sometimes it works. Usually it doesn't.

The Environmental Diagnosis

Diamond's framework asks: Are we degrading our resource base while knowing better?

Exhibit A: Climate. We've known the physics since the 1890s. We've had irrefutable evidence since the 1980s. We've held international conferences, signed accords, made pledges. Emissions continue rising. This is the Easter Island dynamic rendered at planetary scale—we can see the consequences, we understand them, we keep cutting down the trees anyway.

The difference from Easter Island: we're not isolated. There's nowhere else to go. And the consequences operate on decade-to-century timescales, long enough for discounting to make future catastrophe feel like someone else's problem.

Exhibit B: Soil. Industrial agriculture extracts faster than soil regenerates. Best estimates suggest we've lost half of global topsoil in the last 150 years. We mask this with fertilizer—essentially converting fossil fuels into food production. The underlying substrate is degrading while the yields stay high. This is the definition of borrowing from capital while pretending it's income.

Exhibit C: Water. The Ogallala Aquifer feeds 30% of U.S. agricultural irrigation. It's depleting at 1.1 trillion gallons annually—roughly 100 times its natural recharge rate. The North China Plain is worse. India's Punjab is in crisis. We're mining water that accumulated over millions of years and treating it like a renewable resource.

Exhibit D: The sixth extinction. Insect populations have crashed 75% in protected areas over 27 years. A third of reef-building corals are threatened. Two-thirds of monitored wildlife populations have collapsed since 1970. The ecosystem services we depend on—pollination, water filtration, carbon sequestration—are degrading in real time.

The counterargument: we have something Easter Islanders didn't—scientific monitoring. We can measure the drawdown. We can model the trajectories. Awareness enables choice.

But Diamond's entire framework asks: Does knowing help if you can't act on knowledge? The Maya kings knew drought was coming. The Norse Greenlanders knew their cattle were dying. Knowledge without institutional capacity to respond is just documentation.

The Energy Diagnosis

Hall's EROI framework asks: What's our energy return on investment, and which way is it trending?

The concerning numbers: Global oil EROI has dropped from roughly 100:1 in the 1930s to perhaps 15:1 today. The easy oil is gone. We're fracking shale, deep-sea drilling, processing tar sands. Each barrel requires more energy to extract.

Renewables are complicated. Panel-level solar EROI looks good—maybe 10:1 or higher. But the full-system EROI—including storage, grid infrastructure, backup generation for intermittency—is harder to calculate and probably lower. The honest answer is: we don't know yet whether a fully renewable grid can sustain current complexity levels.

Here's what I find genuinely uncertain: the energy transition itself requires enormous energy investment. Building solar panels, wind turbines, batteries, upgraded transmission—all of this consumes energy upfront for returns decades hence. We're doing this as fossil EROI declines. It's a race against the curves crossing.

The hopeful numbers: Solar costs have dropped 90% since 2010. The learning curve continues. Nuclear offers high EROI without carbon—if political will materializes. Fusion may eventually arrive—though we've been saying that for 60 years.

The synthesis: We're attempting an energy transition unprecedented in human history. Previous transitions (wood to coal, coal to oil) moved from lower EROI to higher EROI. We're trying to move from high EROI (fossil fuels, albeit declining) to something still-being-determined EROI (renewables plus storage). This might work. It also might not. The margin of error is smaller than we're comfortable admitting.

The Cliodynamics Diagnosis

Turchin's structural-demographic framework asks: What do the secular cycles look like?

Elite overproduction: Textbook case. Law school applications exceed positions. PhD programs produce more graduates than academic jobs. MBA holders compete for fewer executive tracks. The credentialed aspirants vastly outnumber the positions that justify the credentials. This creates frustrated elite aspirants—historically the most destabilizing demographic.

Popular immiseration: Wages have stagnated for 50 years while productivity doubled. Housing consumes more income than any point in history. The young are definitively worse off than their parents were at the same age—the first time this has happened in American history. When the social contract stops delivering, legitimacy erodes.

State fiscal stress: Debt-to-GDP at peacetime records. Unfunded liabilities in Social Security and Medicare in the tens of trillions. The math requires either inflation (hidden default), explicit default, or growth that may not materialize. Every treasury secretary since 2008 has been buying time.

Political violence: Turchin's models predicted elevated political violence risk peaking around 2020. The data confirmed it—political violence hit levels unseen since the 1970s. This isn't over; it's the middle of a cycle that historically takes decades to resolve.

The counterargument: Turchin's models are new. The sample size of collapsed societies is small. Historical patterns don't guarantee future repetition.

True. But the mechanisms he identifies—elite competition, popular grievance, fiscal constraints—are operating visibly. The patterns might be imperfect predictors, but the indicators they track are measurable. And they're flashing.

The Rigidity Diagnosis

Resilience theory asks: Where are we in the adaptive cycle, and can we restructure?

Signs we're in the rigidity trap:

Just-in-time everything. Supply chains optimized to eliminate slack. Inventory as a liability. The Suez blockage in 2021 disrupted global shipping for weeks. A single ship. One channel. The system has no cushion.

Tight coupling. A cryptocurrency exchange in the Bahamas collapses and sends shockwaves through traditional finance. A disease emerges in one city and reaches every country within weeks. Complexity creates connection creates contagion.

Institutional capture. Existing players have locked in regulatory advantages. New entrants are blocked by barriers that benefit incumbents. The system increasingly serves those who've already won rather than enabling new competition.

Exhausted intervention capacity. Each crisis requires extraordinary measures. The 2008 bailouts. The 2020 stimulus. The Fed's balance sheet expansion. Each intervention has side effects requiring further intervention. We're maintaining stability through escalating extraordinary measures. That's the definition of unsustainability.

The Byzantium question: Can we voluntarily simplify? Can we release some complexity to gain resilience?

Watch the political response to any attempt: proposals to cut regulations trigger industry lobbying. Suggestions to reduce credentialing requirements trigger professional associations. Attempts to streamline bureaucracy trigger public-sector unions. Every piece of complexity has constituents who benefit from it. The system can't voluntarily shrink because every node will fight for survival.

This is the rigidity trap. Not inability to see the problem. Inability to act because action requires consensus from those who benefit from the status quo.

What It Would Actually Look Like

If collapse comes, it probably won't look like Hollywood.

Based on the historical patterns, expect gradual degradation. Services decline. Wait times lengthen. Infrastructure fails more frequently. Things stop working as well. Then they stop working. The change is visible in retrospect, not in the moment.

Expect geographic unevenness. Some regions maintain function while others lose it. Some cities thrive while others hollow out. We already see this: San Francisco and Detroit are in different phases of whatever cycle we're in.

Expect continuation of daily life. People adapt. Local arrangements emerge. The Roman peasant still planted crops after the empire fell—he just didn't pay imperial taxes anymore. Life continues, differently.

Expect elite persistence. The people reading Substack posts about collapse probably have more cushion than average. Elites typically survive collapses better—they have resources, networks, mobility. The fall of Rome was worst for urban middle classes, not for landed aristocrats who became medieval lords.

Expect slow timescale. The Western Roman Empire took centuries to fully fragment. Even rapid collapses like the Maya transformation played out over decades. Modern systems move faster, but "collapse" might still mean your children's world being radically different from yours, not next Tuesday being apocalypse.

Why This Isn't Doom-Mongering

I want to address something directly: you can lay out these patterns without being a collapse influencer selling freeze-dried food.

The frameworks aren't predictions. They're diagnostics. A doctor who tells you that your cholesterol and blood pressure put you at elevated risk for heart disease isn't predicting your death—they're identifying patterns that have historically led to bad outcomes. You can change those patterns. That's the point of the diagnostic.

Every pattern I've described can be altered by human choice:

Complexity accumulation can be addressed through deliberate simplification—though it requires overcoming the constituencies that benefit from existing complexity.

Environmental degradation can be reversed through changed practices—the ozone hole actually shrank because we banned CFCs. It's possible. It requires collective action.

Energy transition is underway. The question isn't whether renewables can work—it's whether the transition happens fast enough and at sufficient scale.

Elite overproduction could be addressed through credentialing reform, alternative status paths, or economic restructuring. Other societies have navigated demographic bulges.

Institutional rigidity can sometimes break through crisis—Byzantium restructured because it had to. Desperation enabled choices that comfort had foreclosed.

The patterns are real. The outcomes aren't predetermined. That's the uncomfortable position—not "everything's fine" or "we're doomed," but "the warning signs are visible and the choices haven't been made yet."

I'd rather know than not know. The frameworks offer that—not certainty, but informed uncertainty.

The Honest Assessment

I've tried to be rigorous rather than alarmist. Here's my synthesis:

What the frameworks show: We're exhibiting patterns consistent with pre-collapse conditions across multiple dimensions. Diminishing returns on complexity: visible. Environmental degradation: documented. Energy transition uncertainty: genuine. Elite overproduction: measurable. Institutional rigidity: obvious. The warning signs aren't speculative—they're in the data.

What the frameworks don't show: Deterministic outcomes. Every past civilization eventually collapsed, but "eventually" does a lot of work. Byzantium restructured and lasted a millennium longer. Some systems navigate crises successfully. The patterns indicate elevated risk, not predetermined doom.

What's genuinely uncertain: Whether our tools—global communication, scientific method, historical awareness—change the calculus enough to matter. Whether the energy transition succeeds before the curves cross. Whether political will emerges before the cycles complete.

The synthesis: We're in a race. Multiple patterns are working against us. We have tools previous civilizations lacked, but we also have complexity levels previous civilizations never imagined. Whether we're Rome (locked in, unable to adapt, heading for centuries of fragmentation) or Byzantium (capable of restructuring, finding sustainable configurations) depends on choices that haven't been made yet.

The historical mortality rate for complex civilizations is 100%. Every one that has existed has eventually simplified, transformed, or been conquered. But that's true of individual humans too, and we still find life worth living.

The question isn't whether collapse is possible—the frameworks show it's normal. The question is whether we're in a generation that will live through transformation, or whether we can navigate to resilience and push the transition decades or centuries away.

I don't know the answer. Nobody does. What I do know: the patterns are visible. The frameworks exist. The diagnostic tools are available.

What we do with the knowledge is the experiment we're running right now.

Further Reading

- Turchin, Peter. End Times: Elites, Counter-Elites, and the Path of Political Disintegration (2023). The structural-demographic case applied to modern America. - Smil, Vaclav. How the World Really Works (2022). The energy fundamentals underlying civilization, from someone allergic to bullshit. - Ord, Toby. The Precipice (2020). Existential risk framing—a different but complementary approach to civilizational vulnerability.

This is Part 8 of 8 in the Collapse Science series. Return to the series hub: "The Science of Collapse."

Comments ()