Douglass North: Institutions Matter

In 1993, Douglass North won the Nobel Prize in Economics for a simple but revolutionary insight: the rules of the game determine economic outcomes more than resources, geography, or technology.

North spent his career asking a question economists had mostly ignored: why do some societies develop while others don't? The standard answers—natural resources, geographic advantages, the right technologies—couldn't explain the variation. Countries with similar resources had wildly different outcomes. Countries with the same technologies developed at different rates.

What did explain the variation was institutional quality. The formal rules (laws, property rights, contract enforcement) and informal constraints (customs, norms, traditions) that structure human interaction. Institutions—not resources—are the primary determinant of economic performance.

This insight seems obvious in retrospect. But it required overturning decades of economic theory that focused on markets while treating institutions as exogenous background conditions. North made institutions the main event.

The Institutional Framework

North defined institutions as "the rules of the game in a society" or, more formally, "the humanly devised constraints that shape human interaction."

Institutions have two components:

Formal institutions: Written rules, laws, constitutions, property rights, contracts. These are explicit and (usually) enforceable. They're what we typically think of as "the system"—the legal and regulatory framework that governs behavior.

Informal institutions: Norms, customs, traditions, codes of conduct. These are implicit and enforced socially rather than legally. They're the unwritten rules that tell you how to behave—what's expected, what's acceptable, what's taboo.

Both matter. Formal institutions can be copied relatively easily (you can adopt another country's constitution), but informal institutions are sticky—they evolve slowly over generations. A country can have good formal institutions and bad informal institutions, and the informal institutions will often win.

This explains a persistent puzzle in development economics: why institutional transplants often fail. You can give a country a new constitution, new property rights laws, new legal codes—and nothing changes. The formal institutions were reformed, but the informal institutions—the actual expectations people operate under—remained the same.

Property Rights: The Foundation

North's most influential work focused on property rights—the institutions that govern who owns what and what they can do with it.

Why do property rights matter so much?

Investment requires security. If you might have your property confiscated, you don't invest in it. Why plant a tree if someone else might harvest the fruit? Why build a factory if the government might seize it? Secure property rights enable long-term thinking.

Exchange requires clarity. Markets only work if you can clearly transfer ownership. If property rights are ambiguous—if it's unclear who owns something or whether a sale is valid—transactions become risky and expensive.

Specialization requires protection. Economic development depends on people specializing in different tasks and trading the results. But specialization makes you vulnerable—you're dependent on others for what you don't produce yourself. You only accept that vulnerability if you trust that your property will be protected.

North's historical research showed that economic development tracked property rights development. The rise of commerce in medieval Europe followed the emergence of institutions that protected merchants' property and enforced contracts. The Industrial Revolution in England was enabled by institutional changes that secured investment returns.

The correlation is robust: countries with secure property rights develop; countries without them don't. Not because property rights are the only thing that matters, but because without them, nothing else can work.

Transaction Costs Revisited

North's framework builds on the concept of transaction costs—the costs of defining, enforcing, and transacting property rights.

In a world without transaction costs (the assumption of classical economics), institutions wouldn't matter. Everyone would have perfect information, contracts would be self-enforcing, and resources would flow to their highest-valued uses automatically.

But transaction costs are ubiquitous. Every exchange involves:

Search and information costs: Finding a trading partner, learning about their offer and reliability.

Bargaining and decision costs: Negotiating terms, writing contracts, agreeing on conditions.

Enforcement costs: Ensuring compliance, monitoring performance, punishing defection.

Institutions reduce these costs. Property rights reduce search costs (you know who owns what). Contract law reduces enforcement costs (the state backstops compliance). Social norms reduce bargaining costs (shared expectations limit negotiation).

The quality of institutions determines the magnitude of transaction costs. Good institutions make exchange cheap; bad institutions make exchange expensive. Since economic development depends on exchange, good institutions enable development while bad institutions prevent it.

Path Dependence and Institutional Lock-In

One of North's most important contributions was recognizing that institutions are path-dependent. History matters. Where you start constrains where you can go.

Path dependence occurs because:

Institutions have increasing returns. Once an institution exists, it's often easier to maintain it than to change it. People adapt to the existing rules. Systems get built around them. The costs of switching increase over time.

Complementarities create lock-in. Institutions don't exist in isolation. They're embedded in systems where different institutions reinforce each other. Changing one institution may require changing many others simultaneously—a much harder task than the initial adoption.

Learning is institution-specific. People develop skills and knowledge adapted to existing institutions. Changing institutions renders that investment obsolete. There's resistance.

Power structures solidify. Institutions create winners and losers. The winners have incentives to protect the status quo. They accumulate resources that let them shape future institutional evolution.

The implications are sobering. Bad institutions can persist even when everyone knows they're bad. The costs of change may exceed the benefits for any individual actor, even if collective change would benefit everyone. Countries can get stuck in "institutional traps" where bad equilibria are self-sustaining.

North pointed to the contrast between North America (where Britain's institutional heritage took root) and Latin America (where Iberian institutional heritage dominated) as an example of path dependence playing out over centuries. The initial institutional conditions created trajectories that persist today.

The historian Niall Ferguson made a similar argument about the "killer apps" of Western civilization—institutional innovations like property rights, rule of law, and competitive markets that enabled divergence from the rest of the world. But North's point is darker: those same institutional advantages aren't automatically transferable. You can't just export them. The conditions for their emergence are specific to their historical context.

This is why so many "shock therapy" reforms failed in the 1990s. Countries like Russia were given market institutions rapidly—privatization, price liberalization, legal reform. But the informal institutions remained Soviet. The formal rules said one thing; actual behavior followed different norms. The result was chaos, corruption, and oligarchy—not flourishing markets.

Beliefs and Institutions

Later in his career, North increasingly emphasized the role of beliefs.

Institutions don't just constrain behavior—they reflect beliefs about how the world works. The formal rules encode some understanding of what problems exist and how to solve them. The informal norms embody cultural beliefs about what's appropriate and effective.

This creates a complex feedback loop:

Beliefs shape institutions: People create rules that reflect their understanding of reality. If you believe property is sacred, you create strong property rights. If you believe the collective owns everything, you don't.

Institutions shape beliefs: Once institutions exist, they influence how people see the world. Growing up under certain rules normalizes them. Institutions become "just how things are."

Beliefs are sticky: Even when circumstances change, beliefs lag. People may cling to institutional arrangements that no longer serve them because the underlying beliefs haven't updated.

This helps explain why institutional change is so hard. You're not just changing rules—you're confronting beliefs about justice, efficiency, legitimacy. The rules have meaning beyond their instrumental function.

Organizations vs. Institutions

North distinguished carefully between institutions and organizations:

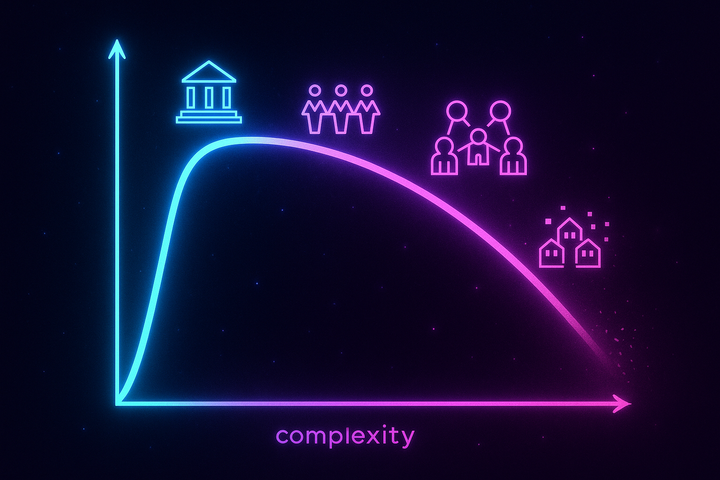

Institutions are the rules of the game. Organizations are the players.

Companies, political parties, churches, universities—these are organizations. They're groups of individuals bound together to pursue objectives. They operate within institutional frameworks, trying to advance their interests given the rules that exist.

The distinction matters because organizations can shape institutions. Powerful organizations lobby for rule changes that benefit them. Wealthy companies capture regulatory agencies. Political parties rewrite electoral rules. Organizations aren't passive—they actively try to change the game they're playing.

This creates a dynamic that can be virtuous or vicious:

Virtuous: Competition between organizations leads to institutional improvements. Organizations that would benefit from better rules push for them. The political process generates institutional evolution.

Vicious: Powerful organizations capture the rule-making process and shape institutions to protect their interests, not the general good. Bad institutions persist because someone benefits from them.

The difference between these dynamics often determines whether a society develops or stagnates.

Consider the history of agricultural marketing boards in many developing countries. Originally created to help farmers get fair prices, they became extractive organizations that bought crops cheaply and sold them expensively, pocketing the difference. The farmers knew the system was bad. The officials knew the system was bad. But the officials benefited, and they had the power to prevent change. The institution persisted not because it worked but because it served entrenched interests.

Or consider regulatory capture in developed economies. Regulatory agencies are created to protect the public interest. But the organizations they regulate have concentrated interests and resources. Over time, the regulated industries often come to dominate the regulators—shaping rules, revolving doors between sectors, influencing who gets appointed. The institutions remain nominally independent while actually serving the interests of those they're supposed to constrain.

The Implications

North's framework has uncomfortable implications:

Development isn't about resources or aid. Countries with terrible institutions will struggle regardless of resources. You can't buy your way out of institutional dysfunction. The billions poured into development aid often fail because they address symptoms while leaving institutional causes untouched.

Institutional change is hard. Path dependence means you can't just import good institutions. They have to grow organically from existing conditions, which may be hostile to the needed changes. Quick reforms often fail; institutional evolution is slow.

There's no guarantee of progress. Nothing ensures that institutional evolution moves in a positive direction. Institutions can degrade. Societies can regress. The arc of history doesn't necessarily bend toward justice—it bends toward whatever the prevailing institutional dynamics produce.

Power matters. Institutions are not neutral arbiters. They reflect and reinforce power distributions. Those who benefit from existing arrangements will fight to protect them. Institutional reform is political struggle.

Copying doesn't work. You can't import good institutions wholesale. You can copy the formal rules, but the informal institutions—the actual beliefs and behaviors—won't follow. Institutional improvement requires organic development, which is slow, uncertain, and path-dependent.

This last point is particularly uncomfortable for those who want to help. Well-meaning reformers often prescribe institutional improvements without recognizing that prescription and adoption are different things. You can tell a country to establish property rights. You can even write the laws. But if the society doesn't believe in property rights—if the informal institutions don't support them—the laws are just paper.

The Legacy

North died in 2015, but his framework has become central to how economists and political scientists think about development, governance, and economic performance.

His core insight remains: you cannot understand economic outcomes without understanding institutional quality. The rules of the game shape everything else. Resources, technology, geography—they matter, but they matter through institutional channels. Good institutions multiply the benefits of resources; bad institutions squander them.

The practical implications are humbling. If North is right, there are no quick fixes for development. Institutional quality takes generations to build. It requires aligning formal rules with informal norms. It requires building organizations that improve rather than capture institutions. It requires patience and persistence that development policy rarely provides.

The Takeaway

Douglass North showed that institutions—the rules of the game—are the primary determinant of economic performance. Property rights, contract enforcement, formal laws, informal norms—these are the infrastructure that enables or prevents development.

Institutions are path-dependent and sticky. History matters. Bad institutions can persist because the costs of change are high and powerful actors benefit from the status quo.

The rules are not just rules. They're the operating system on which everything else runs. Getting them right is the central challenge of human organization. Getting them wrong is why so many societies stay poor while others flourish.

Further Reading

- North, D. C. (1990). Institutions, Institutional Change and Economic Performance. Cambridge University Press. - North, D. C. (2005). Understanding the Process of Economic Change. Princeton University Press. - Acemoglu, D., & Robinson, J. A. (2012). Why Nations Fail. Crown Business.

This is Part 2 of the Economics of Trust series. Next: "Transaction Costs: Why Firms Exist"

Comments ()