The Economics of Trust

Every transaction you make—buying coffee, signing a contract, clicking "I agree"—depends on trust you've never thought about. Trust that the coffee isn't poisoned. Trust that contracts are enforceable. Trust that the company will do roughly what it promised.

This invisible infrastructure of trust is what economists call "institutions." And the study of how institutions create, maintain, and destroy trust turns out to explain most of what matters about how societies work—or don't.

This series explores the economics of trust: how it emerges, why it's expensive to build and cheap to destroy, and what happens when the machinery that produces it breaks down.

What You'll Learn

Douglass North won a Nobel Prize for demonstrating that institutions—the rules of the game—are the primary determinant of economic performance. Countries with good institutions thrive; countries with bad institutions don't. The difference isn't resources or geography. It's trust infrastructure.

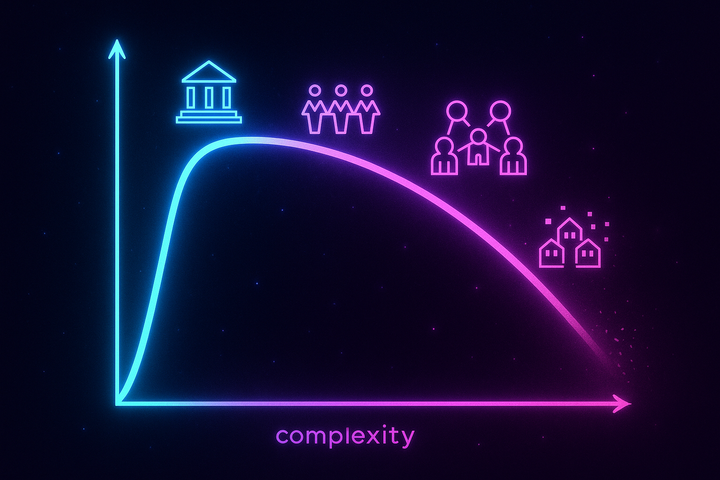

Oliver Williamson explained why firms exist at all. If markets are efficient, why do we need companies? His answer: transaction costs. Without trust, every transaction requires expensive verification. Firms are trust machines that make cooperation cheaper.

Elinor Ostrom overturned the "tragedy of the commons" with empirical research showing that communities can govern shared resources without either privatization or government control. But only if they have the right institutions.

Repeated game theory reveals why cooperation emerges—and why it's so fragile. The folk theorem shows that almost any outcome is possible when interactions are repeated, for better or worse.

Robert Putnam documented the collapse of social capital in America—the bowling alone problem. What happens when the institutions that produce trust wither?

Francis Fukuyama mapped the difference between high-trust and low-trust societies, showing how trust levels constrain what kinds of organizations and economies are possible.

Why This Matters Now

Trust is declining in most developed democracies. Trust in institutions, in expertise, in each other. The effects are visible everywhere: polarization, conspiracy thinking, declining civic engagement, the rise of strongmen promising to cut through broken systems.

Understanding the economics of trust reveals why trust is hard to build and easy to destroy, why some societies maintain it while others lose it, and what—if anything—can be done when the trust machinery starts to fail.

The bad news: you can't just decide to trust. Trust is a rational response to institutional quality. If institutions aren't trustworthy, distrust is appropriate.

The good news: trust is engineerable. Institutions can be designed to produce trust. The economics of trust isn't just diagnosis—it's prescription.

Series Overview

1. Trust Is Expensive to Build, Cheap to Destroy — Introduction to trust economics 2. Douglass North: Institutions Matter — The Nobel-winning framework 3. Transaction Costs: Why Firms Exist — Oliver Williamson on organizational boundaries 4. Elinor Ostrom: Governing the Commons — How communities solve collective action problems 5. Repeated Games: Why Cooperation Emerges — The game theory of trust 6. Social Capital: Bowling Alone — Putnam on declining civic engagement 7. High-Trust vs Low-Trust Societies — Fukuyama on trust and development 8. Synthesis: Building Trust at Scale — Engineering trustworthy institutions

This is the hub page for the Economics of Trust series, exploring how institutions create the invisible infrastructure of trust that makes complex societies possible—and what happens when that infrastructure fails.

Comments ()