EROI: The Number That Runs Everything

In 1930, you could stick a pipe in the ground in East Texas and oil would practically jump out at you. The pressure underground was so high that the first wells were gushers—uncontrollable fountains of black gold. Drillers would cap them, pipe them, and collect.

The energy required to extract that oil was almost nothing compared to the energy the oil contained. For every barrel of oil's worth of energy you invested in drilling and pumping, you got back a hundred barrels. Ninety-nine barrels of pure surplus. Free energy, raining from the sky.

That ratio—energy out divided by energy in—is called EROI: Energy Return on Investment. And in 1930, Texas oil had an EROI of about 100:1.

Today, the global average for conventional oil is around 15:1. For tar sands, it's maybe 5:1. For corn ethanol, it hovers near 1:1—meaning you spend almost as much energy making the fuel as the fuel contains.

This decline isn't just about fuel prices. It's about the material foundation of everything we do.

Every civilization runs on energy. Food production, transportation, manufacturing, heating, cooling, computing—all of it requires energy input. When the net energy available to a society shrinks, the society must shrink to match. Or simplify. Or collapse.

EROI might be the most important number that nobody talks about.

What EROI Actually Measures

The concept is simple enough to explain on a napkin.

Energy Return on Investment is a ratio: energy output divided by energy input. If you spend 1 unit of energy extracting fuel and get 10 units back, your EROI is 10:1. You have 9 surplus units to run your civilization.

Simple. But the implications are profound.

Only the surplus does useful work. The energy you invested in extraction isn't available for anything else—it's already spent. At 10:1 EROI, you get 90% surplus. At 5:1, you get 80%. At 2:1, you get 50%. At 1.1:1, you get a measly 9%.

Below 1:1, you're running backward. An EROI less than 1 means you're consuming more energy than you produce. You're literally burning fuel to lose fuel. Thermodynamic insanity. And yet some biofuels have been accused of exactly this—net energy sinks masquerading as fuel.

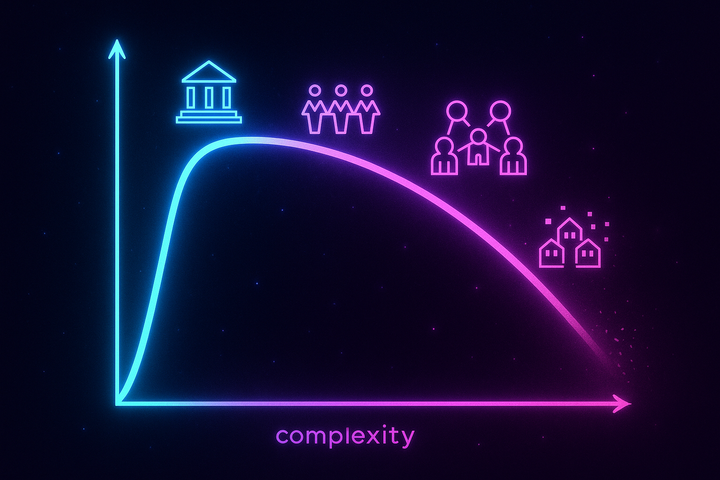

There's a minimum viable EROI for complex societies. You need surplus energy to maintain all the things that make civilization civilized: institutions, infrastructure, specialization, trade networks, education, healthcare, defense. Estimates of the minimum EROI required to sustain a complex modern society range from 5:1 to 10:1. Below that threshold, you can't maintain modernity. Something has to give.

This is the bridge between energy physics and collapse studies. Tainter asks why societies add complexity until they can't sustain it. EROI provides a material answer: because the energy surplus is shrinking.

The Bonanza That Built Modernity

Pre-industrial societies ran on biomass—wood, dung, animal power, human muscle. EROI was modest. Maybe 5:1 to 10:1 for well-managed agriculture. Enough to support agrarian empires, priests and scribes and standing armies—but not industrial civilization.

Then we discovered fossil fuels. First coal. Then oil. And everything changed.

Early coal had spectacular EROI. The best seams were near the surface in Britain and Pennsylvania. You could practically pick it up off the ground. The energy density was incredible—far more joules per kilogram than wood.

Early oil was even better. In the 1930s, oil gushed from wells in Texas and the Persian Gulf. The energy required to extract it was negligible compared to what it delivered. 100:1. 80:1. Sometimes higher. Liquid energy, easy to transport, easy to refine, powering engines that could do the work of a hundred horses.

This energy bonanza built the modern world. Industrialization—machines replacing muscle at scales previously unimaginable. Urbanization—millions of people concentrated in cities that could be fed and heated and supplied. The Green Revolution—fertilizers and tractors and irrigation turning marginal land into breadbaskets, quintupling crop yields, feeding a population that grew from 2 billion to 8 billion in a century. Global trade—shipping containers crossing oceans, supply chains spanning continents. Air travel. Computing. The internet. All of it running on the surplus from that incredible energy return.

We built a civilization on 100:1 and assumed that was normal.

It wasn't. It was a one-time inheritance—millions of years of ancient sunlight concentrated by geology into deposits we've been liquidating for two centuries.

The Geology of Decline

There's a principle in resource extraction that seems obvious once you hear it: you extract the easy stuff first.

The first oil fields were shallow, highly pressurized, and enormous. Oil practically jumped out of the ground. The Ghawar field in Saudi Arabia—largest ever discovered—has been pumping since 1951. The Permian Basin in Texas. The North Sea. These were the low-hanging fruit.

Those fields are now depleted or in decline. What's left is different: deeper, smaller, farther offshore, locked in shale rock, bound up in tar sands. Each barrel requires more energy—more drilling, more pumping, more processing—to extract.

Conventional oil: EROI has fallen from roughly 100:1 in 1930 to about 30:1 by 1970 to maybe 15:1 today as a global average. And the trend continues downward.

Tar sands: 3:1 to 5:1. You have to mine the sand, heat it to liquefy the bitumen, upgrade it into something usable. Enormous energy input for modest energy output.

Shale oil: 5:1 to 10:1. Horizontal drilling, hydraulic fracturing, constant new drilling because wells deplete in months instead of decades.

Deepwater offshore: Lower than conventional onshore. The Deepwater Horizon wasn't drilling in the Gulf of Mexico because that was the easy option—it was drilling there because that's where the oil still was.

The pattern is clear. Each new barrel delivers less net energy to society than the barrel before. We're pumping more oil than ever while the net energy contribution shrinks.

The Net Energy Cliff

Here's where the math gets scary.

The relationship between EROI and net energy isn't linear. It's a cliff.

At 100:1 EROI, you get 99% net energy. At 10:1 EROI, you get 90% net energy. At 5:1 EROI, you get 80% net energy. At 2:1 EROI, you get 50% net energy. At 1.5:1 EROI, you get 33% net energy. At 1.1:1 EROI, you get 9% net energy.

See the shape? The curve is gentle at high EROI and nearly vertical at low EROI.

Going from 100:1 to 10:1 costs you only 9 percentage points of net energy—hardly noticeable. Going from 2:1 to 1.5:1 costs you 17 percentage points—devastating.

This means EROI decline accelerates in its effects. As you move down the curve, each step hurts more than the last. You can pump the same gross volume of oil—the headline number everyone reports—while delivering dramatically less net energy to run society.

This is the "net energy cliff." And we're sliding toward it, pumping ourselves breathless to stay in place.

The Renewable Question

Can renewables save us from the cliff?

The honest answer: maybe, but nobody really knows.

Solar PV: EROI estimates range from 10:1 to 20:1, depending on manufacturing energy, installation, geographic location, and where you draw system boundaries. Better than tar sands. Worse than 1930s Texas oil. And improving as technology advances.

Wind: 15:1 to 25:1 for good sites. Among the best renewables. But the best sites get developed first—same geological principle applies. The marginal wind farm is worse than the average.

Hydro: 40:1 to 100:1 for ideal sites. Excellent. But the ideal sites are already dammed. You can't build another Hoover Dam in a flat cornfield.

Biofuels: 1:1 to 3:1 for corn ethanol. Many analysts suspect corn ethanol is actually a net energy sink when you count everything—a way to convert natural gas (for fertilizer) and diesel (for tractors) into liquid fuel, with net energy loss.

Nuclear: Estimates vary wildly—from 5:1 to 75:1—depending on what you count. High energy density. Low carbon. But enormously capital-intensive, politically fraught, and slow to build.

The complications multiply:

Intermittency. Solar produces when the sun shines. Wind produces when the wind blows. Managing that variability requires storage (batteries, pumped hydro) and grid upgrades—all of which consume energy. The system EROI, including storage, is lower than the generation EROI.

Materials. Solar panels need silicon, silver, and rare earth elements. Wind turbines need steel, copper, and neodymium. Mining and refining those materials consumes energy. The full lifecycle EROI includes these costs.

Transition energy. Building a new energy infrastructure requires energy—and for now, mostly fossil fuel energy. During transition, you're spending old energy to build new sources. The total surplus available might decline before it improves. We're rebuilding the ship while sailing it.

The optimists say renewables can maintain technological civilization at roughly current complexity—that improving technology will push solar and wind EROI high enough to compensate for fossil decline. The pessimists say renewable EROI is structurally lower than the fossil bonanza, and the transition will consume more than it generates. The honest answer: we've never done this before at civilization scale, so nobody actually knows.

EROI and the Collapse Frameworks

EROI puts a hard material foundation under Tainter's complexity argument.

Why does complexity accumulate? Because energy surplus makes it possible. At 100:1 EROI, there's ample surplus to fund elaborate institutions, specialized roles, professional bureaucracies, standing armies, universities, healthcare systems. Complexity is a luxury you can afford when energy is cheap.

Why do returns on complexity diminish? Partly because the energy surplus funding it is itself shrinking. Each increment of complexity draws from a smaller pool.

Why do societies collapse into simpler forms? Because they've built complexity that requires more energy surplus than exists. The structure becomes too expensive to maintain.

Tainter's curve and the net energy cliff are the same story told in different languages. Complexity and energy are married. You can't divorce one from the other. When energy surplus shrinks, complexity must follow—gracefully if you're lucky, catastrophically if you're not.

Why Nobody Discusses This

If EROI is so important, why isn't it a headline in every newspaper? Why don't economists track it? Why don't politicians debate it?

Several reasons.

It's invisible. You can't see EROI decline. You see gas prices, oil production statistics, economic indicators—but net energy doesn't have a dashboard. The number that matters most is the number nobody measures.

It's slow. EROI decline happens over decades. Political attention operates on cycles of months. By the time the trend is undeniable, it's also irreversible.

It's threatening. If EROI analysis is correct, some implications are uncomfortable. Economic growth may be physically limited. Technological optimism may be misplaced. The transition to renewables may be harder than the glossy brochures suggest. Nobody wants to deliver that news.

It's contested. EROI calculations require assumptions about system boundaries, energy quality, and lifecycle accounting. Different researchers get different numbers. Skeptics can always point to measurement uncertainty and say the whole framework is unreliable.

It contradicts the narrative. The story we tell ourselves is that human ingenuity always finds a way, that technology solves scarcity, that limits are just problems waiting for solutions. EROI suggests that some limits are thermodynamic—not problems to be solved but constraints to be lived within. That's a hard sell.

So the most important number nobody talks about remains the number nobody talks about. The constraint is real whether or not we acknowledge it. Thermodynamics doesn't require human consensus.

The Silent Squeeze

EROI decline doesn't announce itself. There's no alarm bell when you cross a threshold. It shows up as:

Slower growth. Economists puzzle over why productivity gains are stalling, why growth rates have fallen across developed economies. Maybe the explanation is simple: there's less net energy available for growth.

Inflation. More economic activity is required to produce the same net output. Prices rise for "mysterious" reasons that economists attribute to policy or psychology.

Deferred maintenance. When surplus shrinks, the first thing to go is maintenance. Infrastructure slowly degrades. Potholes don't get filled. Bridges don't get inspected. Systems run longer between repairs.

Rising inequality. When the pie stops growing, elites fight to protect their share—and they usually win. Everyone else stagnates or declines.

Political instability. Frustrated populations blame immigrants, elites, the other party, globalization, technology—anything but the thermodynamic constraint that nobody discusses.

These symptoms are familiar. We attribute them to policy failures, corrupt politicians, cultural decay, technological disruption. But underneath might lie a simpler driver: there's less net energy to work with, and everyone's fighting over a shrinking surplus without understanding why it's shrinking.

The Honest Position

What we know:

- EROI for fossil fuels has declined significantly over a century - Remaining fossil resources are lower-EROI than what we've already extracted - Renewables have moderate EROI—better than tar sands, worse than the fossil bonanza - Complex societies require surplus energy to maintain complexity - The net energy cliff is real, and we're moving toward it

What we don't know:

- Where exactly the minimum viable EROI threshold sits - Whether renewables plus efficiency can keep us above it - How fast the transition can happen - Whether the curve bends gradually or eventually snaps

EROI isn't a crystal ball. It doesn't predict collapse dates or tell you which society will fail first. What it does is identify a constraint—a hard physical limit on what's possible.

Thermodynamics doesn't care about your politics, your economic theory, or your optimism. You can't run a civilization on energy you don't have.

What we do within that constraint—that's still up for grabs.

Further Reading

- Hall, C.A.S. & Klitgaard, K.A. (2012). Energy and the Wealth of Nations. Springer. - Murphy, D.J. & Hall, C.A.S. (2010). "Year in review—EROI or energy return on (energy) invested." Annals of the New York Academy of Sciences. - Smil, V. (2017). Energy and Civilization: A History. MIT Press.

This is Part 4 of the Collapse Science series. Next: "Seshat: Quantifying 10,000 Years."

Comments ()