Debt: The First 5,000 Years

You've probably heard this story: Before money, people bartered. I have fish, you have wheat, we trade. But what if I want wheat and you don't want fish? Inconvenient. So we invented money—a universal medium of exchange that solved the "coincidence of wants" problem.

It's a tidy story. It appears in every economics textbook. Adam Smith told it in 1776.

There's just one problem: it's completely made up. There is no evidence—archaeological, anthropological, or historical—that barter economies ever existed. When anthropologists study non-monetary societies, they don't find people haggling fish for wheat. They find something else entirely.

They find debt.

The Origin Myth

The barter story is powerful because it makes money seem natural—an inevitable technological solution to an obvious problem. If money evolved naturally from barter, then money is as old as human exchange itself. Markets are primordial.

David Graeber's Debt: The First 5,000 Years (2011) demolishes this story. Graeber, an anthropologist and anarchist activist (who later co-authored The Dawn of Everything), spent the book tracing what actually happens in societies without formal money.

The economists' hypothetical barter economy—people meeting as strangers to exchange discrete goods—simply doesn't exist in the historical record. What we find instead is something more like an accounting system. Debt came first.

In village economies, people didn't exchange equivalent values. They kept running tabs. I give you wheat today; you'll give me something later. Maybe fish, maybe labor, maybe something else entirely. The accounts might never balance—and that was the point. An unpaid debt meant an ongoing relationship.

Caroline Humphrey, an anthropologist who surveyed the evidence, put it bluntly: "No example of a barter economy, pure and simple, has ever been described, let alone the emergence from it of money." The sequence economists assume—barter then money—is a thought experiment, not history.

Money, when it emerged, wasn't invented to facilitate trade. It was invented to quantify debts—often violent debts. Slave prices. War reparations. Bride-prices. Wergild (the payment owed for killing someone). The earliest recorded uses of money aren't commercial transactions. They're compensations for violence.

Debt as Social Technology

This reframes everything.

If money emerged from debt, then money is a technology for quantifying and making transferable what was previously embedded in social relationships. Before money, if I owed you something, that was between us—a relationship. After money, that obligation could be expressed as a number, written down, and transferred to someone else.

Debt is older than money. But money transforms debt.

Traditional debts were relational. They depended on ongoing social connection. They couldn't be separated from the parties involved. They were often never meant to be fully repaid—an unpaid obligation kept the relationship alive.

Monetary debts are impersonal. They can be bought and sold. They exist independently of the original relationship. They're meant to be paid—and when they're paid, the relationship ends.

This is what Graeber calls the shift from "human economies" to "commercial economies." In human economies, the fundamental transactions are about people—marriages, blood debts, obligations. In commercial economies, the fundamental transactions are about things—commodities with prices.

The Violence Underneath

One of Graeber's most provocative claims: the origins of money are violent.

The earliest commodity money appeared alongside warfare, slave-trading, and state formation. Coins were invented not to buy vegetables in the marketplace but to pay soldiers and collect taxes. The classical world ran on slaves, and slaves had prices.

Graeber traces this through multiple examples:

Mesopotamian temple economies. The earliest units of account (the shekel, the mina) were used to denominate debts, taxes, and palace wages—not market exchanges. The temples and palaces created money; markets used it later.

Greek and Roman coinage. Coins appeared in the context of armies, slavery, and plunder. Alexander the Great paid his troops in coins minted from Persian treasure. Rome's monetary economy was inseparable from its slave economy.

The transatlantic slave trade. The triangle trade created complex credit relationships across the Atlantic. European goods were advanced on credit to African traders; slaves were the collateral; sugar and tobacco paid the debts. The entire system ran on credit, debt, and violence.

The pattern: states, empires, and violent extraction create the conditions for monetary economies. Markets are never the pristine spaces of free exchange that economic theory imagines. They emerge from power.

The Great Cycles

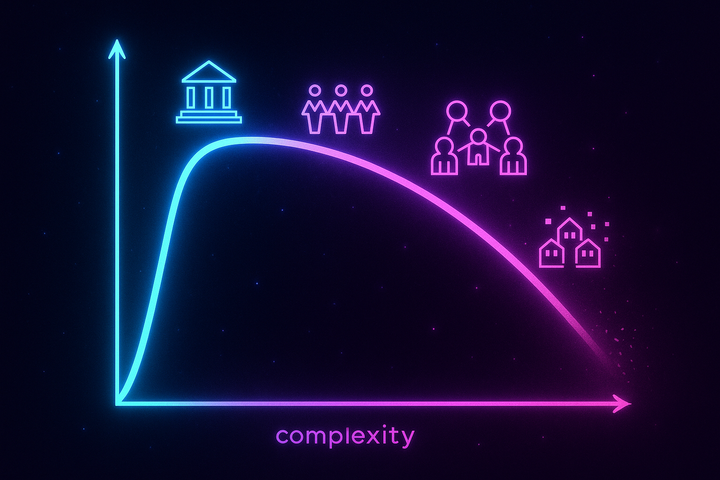

Graeber proposes a cyclical pattern in monetary history:

Credit money ages. In periods of relative stability and low violence, economies run on credit and trust. Ancient Mesopotamia, medieval Europe, post-war America—these are periods of elaborate credit relationships, virtual money, and social embedding of exchange.

Cash money ages. In periods of imperial expansion, warfare, and slave-trading, economies run on metal coins. Classical antiquity, the early modern period of colonial expansion—these are periods of plunder, hard currency, and impersonal exchange.

The pattern is striking. The axial age (800 BCE - 600 CE)—the period of great empires, mass slavery, and philosophical transformation—was a cash money age. Coins proliferated. Markets expanded. Violence was endemic.

The medieval period (600 - 1500 CE) was largely a credit money age. Coins became scarce. Trade was conducted through credit arrangements, tally sticks, and bills of exchange. Violence decreased (though hardly disappeared).

The modern period (1500 - 1971) was another cash money age. Colonial extraction required cash. The gold standard tied money to metal. Slavery returned on an unprecedented scale. Now we're in another transition—money becoming virtual again, credit relationships proliferating, but with a new twist: the institutions managing that credit have become predatory.

The cycle matters because different forms of money have different social implications. Credit money tends toward community, relationship, and moral economy. Cash money tends toward anonymity, violence, and what Graeber calls "cold calculation."

We're currently in a transition. The 20th century was largely a credit money age—checks, bank accounts, credit cards. But the 2008 financial crisis revealed how credit systems can become predatory. The contemporary debate about cryptocurrency is partly a debate about what kind of money we want.

The Morality of Debt

Debt is morally charged in ways other obligations aren't.

Why is it wrong not to pay your debts? The question seems silly—of course you should pay what you owe. But Graeber points out that this moral intuition is remarkably powerful and remarkably asymmetric.

Debtor's prisons. Personal shame. Moral condemnation of the bankrupt. We treat debt as a sacred obligation even when the lending was predatory, even when repayment is impossible, even when the debt was created through fraud.

But why? Graeber's answer: the morality of debt serves the creditor. If debtors feel morally obligated to pay, creditors don't need expensive enforcement. The shame does the work.

This moral asymmetry is visible in how we talk about debt crises. When individuals or countries can't pay, we moralize—they were irresponsible, they lived beyond their means, they must suffer the consequences. But when banks or creditors made bad loans? That's just business. When they get bailed out? That's necessary for the system.

"What is a loan shark, really, but a loan shark with an army and a flag?" That's Graeber on sovereign debt collection.

The Jubilee Tradition

Ancient societies knew that debt tends toward crisis. Debts compound. Debtors can't pay. Assets concentrate. Eventually, the system collapses or revolts.

The solution was debt cancellation. Jubilee years in ancient Israel. Clean slate proclamations in Mesopotamia. Debt cancellation by rulers across the ancient Near East.

The Mesopotamian evidence is striking. New rulers regularly proclaimed "clean slates"—andurarum in Akkadian, literally "freedom." All debts were cancelled. Debt slaves were freed. The economy reset. This happened every few decades, as a matter of policy.

The Biblical Jubilee (Leviticus 25) prescribed something similar: every fifty years, debts cancelled, slaves freed, land returned to original owners. Scholars debate whether the Jubilee was ever actually practiced, but the principle was clear—perpetual debt accumulation was recognized as socially destructive.

These weren't acts of charity. They were system maintenance. A society where a small number of creditors own everything while everyone else is in permanent debt bondage is a society headed for collapse. Periodic reset was the alternative to revolution.

Graeber argues we've forgotten this. Modern societies treat debt as sacred and eternal. The idea that debts might simply be cancelled—as happened regularly in the ancient world—seems radical or impossible. We've lost the technology.

But debts are always cancelled somehow. Either through orderly jubilee, or through crisis—default, inflation, revolution. The only question is whether the cancellation is managed or chaotic. Orderly cancellation is a policy choice. Chaotic cancellation is what happens when you refuse to make that choice until it's too late.

Why This Matters Now

We live in an age of debt. Student debt. Medical debt. Mortgage debt. Consumer debt. Sovereign debt. The scale is unprecedented.

American student loan debt exceeds $1.7 trillion. Medical debt is the leading cause of bankruptcy. Mortgage debt collapsed the global economy in 2008. Consumer debt finances everyday life for millions. Sovereign debt constrains what governments can do.

Graeber's analysis suggests this isn't an accident. Debt is a power relationship. When everyone is in debt, creditors have power. When debt is moralized, that power is secured by shame rather than force.

The 2008 crisis revealed how the debt system works. Banks that made predatory loans were bailed out. Homeowners who couldn't pay were foreclosed. The moral asymmetry was visible: creditors got protection, debtors got blame.

Think about how we talk about it. A family that can't pay medical bills is "irresponsible." A bank that made billions in bad loans gets rescued because it's "too big to fail." The language itself encodes the asymmetry.

Movements like Occupy Wall Street (where Graeber was active) and debt strike campaigns emerged partly from this analysis. If debt is a power relationship, not just a market transaction, then debtor organization becomes possible. If debts have been cancelled throughout history, debt cancellation becomes imaginable.

The book's analytical point is also a political one: the way we think about debt shapes what seems possible. If we imagine money emerging naturally from barter, we naturalize market relations. If we understand debt as older than money and intertwined with violence, different arrangements become thinkable.

The Takeaway

The barter myth is a just-so story. There's no evidence it ever happened. What we find instead is debt—social obligations that preceded and shaped monetary exchange.

Money emerged not from commerce but from violence—slave prices, war reparations, state taxation. The moral weight we give to debt repayment serves creditors, not some abstract justice.

Debt is a power relationship that we've naturalized as a moral one. Understanding its history denaturalizes it. If debts have been cancelled throughout history, if the morality of debt serves particular interests, if alternatives have existed—then alternatives remain possible.

Every discussion of debt—student loans, sovereign default, household bankruptcy—is also a discussion of power. Graeber wanted us to remember that.

Further Reading

- Graeber, D. (2011). Debt: The First 5,000 Years. Melville House. - Hudson, M. (2018). ...and Forgive Them Their Debts: Credit and Redemption. ISLET. - Polanyi, K. (1944). The Great Transformation. Beacon Press.

This is Part 4 of the Anthropology of Institutions series. Next: "Dunbar's Number"

Comments ()