High-Trust vs Low-Trust Societies

Francis Fukuyama made his name predicting the end of history. His more lasting contribution might be his analysis of trust.

In Trust: The Social Virtues and the Creation of Prosperity (1995), Fukuyama argued that a society's level of generalized trust—trust extended to strangers beyond family and clan—is one of the most important determinants of its economic structure and potential.

High-trust societies produce large-scale organizations naturally. Low-trust societies struggle to scale beyond family firms. This difference shapes everything from corporate structure to economic development to political stability.

Trust isn't just nice to have. It's structural.

The Trust Radius

Every society has a "radius of trust"—the circle within which people extend trust to others.

In some societies, this radius is wide. You trust strangers. You assume good faith in business dealings. You believe most people will follow the rules. This is "generalized trust"—trust extended beyond personal relationships to the society at large.

In other societies, the radius is narrow. You trust only family, kin, and clan. Strangers are presumed to be potential cheaters. Business depends on personal relationships. Formal rules are for suckers; everyone knows the real game is relationships and corruption.

Fukuyama observed that the radius of trust shapes the scale of social organization that's possible.

If you only trust family, your businesses will be family firms. When the patriarch dies, the firm fragments among competing heirs. The firm can never grow beyond what family members can manage.

If you trust strangers, you can build corporations with professional management, meritocratic hiring, and complex organizational structures. The firm can outlive its founders and grow to enormous scale.

Trust radius determines organizational scale. And organizational scale determines economic capability.

The High-Trust Societies

Fukuyama identified several high-trust societies: the United States (at least historically), Germany, Japan, and Scandinavia.

These societies share characteristics:

Strong civil society. Dense networks of voluntary associations—clubs, churches, professional organizations—that create trust across family lines. This is Tocqueville's America, Putnam's social capital.

Cultural values supporting trust. Whether Confucian, Protestant, or secular, some cultural framework that makes honoring commitments and treating strangers fairly a moral imperative.

Effective institutions. Legal systems that work, contracts that are enforced, property rights that are respected. The institutional infrastructure that makes trust rational.

Historical contingency. In some cases, specific historical experiences—war, nation-building, religious reform—that created the conditions for trust to develop.

High-trust societies can build large corporations with complex bureaucracies, coordinate large-scale public projects, and sustain the impersonal institutions that modern economies require. Trust is the lubricant that makes these complex systems work without excessive friction.

The Low-Trust Societies

Low-trust societies have the opposite pattern. Fukuyama's examples included southern Italy, much of Latin America, and China (at least at the time of writing).

These societies share characteristics:

Family-centric culture. Loyalty flows to family first, then kin, then perhaps coreligionists or co-ethnics. Strangers are outside the circle of obligation.

Weak civil society. Few voluntary associations crossing family lines. What associations exist often corrupt themselves—captured by families seeking advantages.

Weak institutions. Formal rules are selectively enforced, often for personal advantage. Contracts are suggestions. Property depends on power. The institutional infrastructure invites defection rather than cooperation.

Corruption as system. Corruption isn't an aberration—it's how the system works. You get things done through connections, favors, and bribes, not through formal channels.

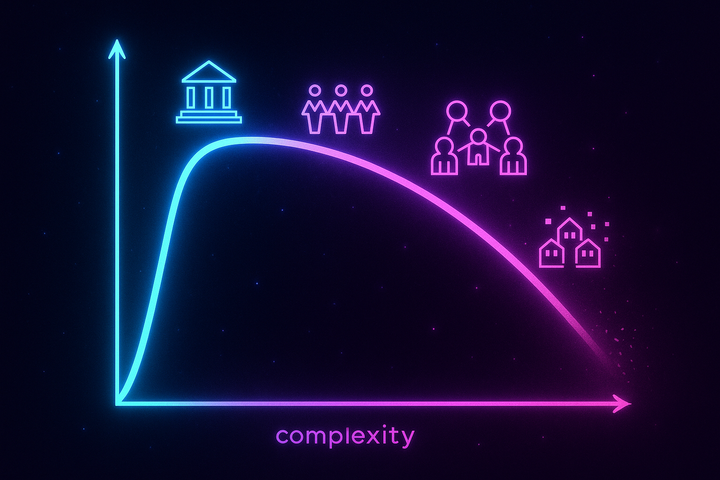

In low-trust societies, large-scale organization is hard. Corporations struggle because you can't hire strangers into positions of trust. The state fills the gap, becoming the primary large-scale organization because it has coercive power that private actors lack. But state-owned enterprises often perform poorly, and the state itself is often corrupt.

The Economic Consequences

The trust differential has profound economic implications.

Firm structure. High-trust economies have many large private corporations. Low-trust economies have family firms plus state enterprises, with little in between. The "missing middle"—medium-sized professional firms—is a symptom of low trust.

Industrial development. Some industries require large-scale organization: steel, automobiles, aerospace, complex manufacturing. These industries are harder to develop in low-trust societies. Family firms can't reach the necessary scale; state enterprises often can't reach the necessary quality.

Innovation. Innovation often happens in large organizations with professional R&D. It also happens in startups, but startups in low-trust environments struggle to attract outside investment (investors don't trust strangers) or to hire professional management (employees don't trust founders). Innovation is throttled by the trust deficit.

Transaction costs. Every business deal in a low-trust environment requires more verification, more insurance, more relationship-building. These transaction costs are a tax on economic activity. High-trust economies simply function more efficiently.

Foreign investment. Foreign companies are reluctant to operate in low-trust environments. They can't rely on local institutions for contract enforcement. They face corruption and expropriation risk. Capital flows to where trust makes investment safer.

The cumulative effect is that high-trust societies are systematically richer. Not because of natural resources or geographic advantages, but because trust enables the organizational complexity that modern economies require.

The Examples

Consider the contrast between Italy's north and south.

Northern Italy—Lombardy, Emilia-Romagna—has dense civil society, high trust, and vibrant economies featuring both large corporations and networks of specialized small firms. When Putnam studied Italian regional governments, the north outperformed the south dramatically on every measure of government effectiveness.

Southern Italy—Sicily, Calabria—has thin civil society, family-centered trust, and persistent underdevelopment. The state tries to compensate but is itself riddled with corruption. Organized crime fills the institutional vacuum, providing protection and contract enforcement that the state cannot. Development lags despite decades of transfer payments.

The difference isn't geography, genes, or resources. It's trust. And that trust difference traces to historical patterns of civic engagement stretching back centuries—as Putnam documented, to the different institutional legacies of Norman rule in the south versus independent city-states in the north.

Or consider the difference between South Korea and the Philippines. Both started at similar development levels in the 1960s. Korea achieved high-trust industrial development: large corporations (chaebol), effective state coordination, rapid industrialization. The Philippines remained trapped in low-trust patterns: family businesses, weak institutions, oligarchic capture.

The difference isn't culture in any simple sense—both are Asian societies with Confucian influences. It's trust infrastructure: the specific institutional histories and social structures that enable or prevent scaling trust beyond kin.

China: The Interesting Case

Fukuyama classified China as low-trust at the time of writing. Chinese culture emphasizes family loyalty; Chinese businesses are overwhelmingly family firms; generalized trust levels were low in surveys.

Yet China achieved extraordinary economic growth in the following decades. How?

Several explanations:

The state as trust substitute. The Chinese state provided the large-scale organization that private low-trust actors couldn't. State-owned enterprises led heavy industry. State direction coordinated industrial policy. The state substituted for missing private trust.

Foreign firms and their trust. Foreign companies brought their own trust—their organizational capabilities, their supply chains, their management practices. China captured the manufacturing by providing labor and infrastructure; foreigners provided the trust-intensive coordination.

Changing trust levels. Rapid urbanization, education, and market experience may be raising trust levels. The Cultural Revolution destroyed traditional institutions; what's emerging may have different trust properties.

Networks as trust substitute. Guanxi—personal relationships and networks—enables trust within networks even when generalized trust is low. Chinese business runs on guanxi in ways that substitute for generalized trust.

China suggests that trust deficits can be worked around—but the workarounds have costs and limits.

Trust and Political Order

Trust affects not just economics but political stability.

Low-trust societies have weak states. When people don't trust strangers to follow rules, they don't comply with rules themselves. Tax collection is hard. Laws are ignored. The state lacks the voluntary compliance that functional government requires.

Or they have authoritarian states. Low trust can also produce strong-arm regimes that compensate for missing voluntary compliance with coercion. If you can't trust people to cooperate voluntarily, you force them to cooperate through punishment.

High-trust societies can sustain democracy. Democratic governance requires people to accept losses gracefully, trust that the system will produce acceptable outcomes over time, and believe that others are following the rules. This trust is not automatic; it's produced by experience and reinforced by institutions.

Trust declines have political consequences. As generalized trust declines in developed democracies—Putnam's bowling alone problem—we see political consequences: polarization, institutional distrust, declining democratic norms. The trust infrastructure that sustained democratic governance is eroding.

Can Trust Be Built?

If trust is so important, can it be increased?

Fukuyama was cautiously pessimistic. Trust is deeply embedded in culture, accumulated over generations. You can't will it into existence.

But some factors seem relevant:

Effective institutions. Fair, predictable institutions that enforce rules impartially make trust rational. Over time, this rationality might become habit. Building trust starts with building trustworthy institutions.

Civil society. Voluntary associations that cross family lines create the experiences and networks that generate trust. Supporting civil society supports trust development.

Education and contact. Exposure to diverse others—through education, media, mobility—can expand the trust radius. You learn that strangers aren't so dangerous.

Economic development itself. As economies develop, the payoffs to cooperation increase. This shifts incentives toward trust-building. There may be a virtuous cycle where development produces trust, which enables more development.

Avoiding trust destruction. Many policies destroy trust faster than anything can build it. Corruption, institutional betrayal, discrimination—these set back trust development dramatically. First, do no harm.

Historical contingency. Some societies' trust levels trace to specific historical shocks—wars that forged national identity, movements that created shared experience, reforms that established institutional credibility. You can't manufacture these, but you can recognize when they're happening and protect what they create.

The honest answer: we know trust matters enormously, and we know little about how to build it. The societies that have it accumulated it over centuries through processes we don't fully understand. The societies that lack it face a chicken-and-egg problem: you need trust to build the institutions that produce trust.

The American Trajectory

Fukuyama wrote about America as a high-trust society. But that was 1995—before the trends that Putnam documented had fully manifested.

Today, the picture is more complicated.

Generalized trust has declined substantially—from 55% in 1960 saying "most people can be trusted" to under 35% today. Trust in institutions—government, media, corporations—has fallen further. Polarization has created communities with dense internal trust (bonding capital) but little trust across political lines (bridging capital).

America is becoming more like a low-trust society, with consequences that match the theory:

- Declining ability to coordinate large-scale collective action - Retreat to tribal loyalties and family-like factions - Institutions captured by narrow interests - Rising transaction costs in every domain

This isn't inevitable. But it suggests that high-trust status isn't permanent. Trust can be accumulated over generations and dissipated in decades. The infrastructure requires maintenance.

The Takeaway

High-trust societies can build large organizations, coordinate complex activities, and sustain the impersonal institutions that modern economies and democracies require. Low-trust societies are limited to family firms and state enterprises, with all the constraints that implies.

The trust radius—how far trust extends beyond family—shapes organizational scale, economic development, and political stability. This isn't a minor variable. It's structural.

Trust is accumulated social capital, built over generations, encoded in culture and institutions. Societies that have it should guard it carefully. Societies that lack it face a long, uncertain path to building it.

Understanding this helps explain why some societies develop while others don't, why some democracies work while others collapse, and why the erosion of trust in developed societies is so concerning.

Further Reading

- Fukuyama, F. (1995). Trust: The Social Virtues and the Creation of Prosperity. Free Press. - Fukuyama, F. (2011). The Origins of Political Order. Farrar, Straus and Giroux. - Algan, Y., & Cahuc, P. (2010). "Inherited trust and growth." American Economic Review.

This is Part 7 of the Economics of Trust series. Next: "Synthesis: Building Trust at Scale"

Comments ()