The Resource Curse: Oil and Authoritarianism

In 1959, the Netherlands discovered one of the world's largest natural gas fields. Within a decade, Dutch manufacturing was collapsing. The gas exports had pushed up the currency, making Dutch manufactured goods uncompetitive abroad. Factories closed. Workers were laid off. A country had been made poorer by becoming richer.

Economists named this "Dutch Disease"—the paradox where resource wealth undermines other economic sectors. But the deeper phenomenon, the "resource curse," extends beyond economics. In many countries, resource wealth correlates with authoritarianism, conflict, and underdevelopment.

This seems backward. Resources should enable development. Yet empirically, oil-rich countries are often more authoritarian, more unequal, and more prone to civil war than resource-poor neighbors. Geography doesn't just shape borders and terrain—it distributes resources, and that distribution shapes political possibilities.

The Paradox of Plenty

Resource-rich countries often underperform economically:

Venezuela has the world's largest proven oil reserves. It should be wealthy. Instead, it's experienced economic collapse, hyperinflation, and mass emigration. Oil funded populist spending that created dependencies, crowded out other industries, and enabled corruption that eventually destroyed the economy.

Nigeria is Africa's largest oil producer. Yet most Nigerians live in poverty. Oil revenue has funded conflict in the Niger Delta, corruption throughout the government, and a weak manufacturing sector that never developed because oil made imports cheap.

Saudi Arabia is wealthy but has failed to diversify despite decades of trying. Oil revenue enables a state that doesn't need to tax citizens—and therefore doesn't need their consent. The social contract is rentier: wealth flows from the ground, not from productive activity.

Norway is the exception that proves something is possible but also highlights how unusual it is. Norway's oil fund has avoided most resource curse dynamics through exceptional institutions—but Norway had strong institutions before it found oil.

The pattern: countries that discover resources often do worse than they would have without them. The resources become the problem.

This isn't universal—Australia, Canada, and the United States have substantial resources without the curse. But these countries developed strong institutions before or alongside resource extraction. Countries that discovered resources before developing institutions face much worse outcomes. The sequence matters enormously.

The Economic Mechanisms

Several mechanisms explain the economic resource curse:

Dutch Disease. Resource exports raise the exchange rate. Other exports become uncompetitive. Manufacturing shrinks. When resources deplete or prices fall, there's no industrial base to fall back on.

Volatility. Resource prices fluctuate wildly. Countries that depend on them experience boom-bust cycles. Planning becomes impossible. Booms create spending commitments that busts can't fund.

Crowding out. Resource extraction requires relatively little labor. It doesn't create the broad employment that manufacturing does. A country can export billions in oil while most citizens remain poor.

Rent-seeking. When wealth comes from a hole in the ground rather than from productive activity, the way to get rich is to control the hole—through politics, corruption, or force. Energy that would otherwise go to building businesses goes to capturing rents.

Human capital neglect. Why invest in education when wealth comes from extraction? Resource-rich countries often underinvest in their people because they don't need skilled labor for their primary industry. This creates long-term weakness even when short-term revenue is high.

The Political Mechanisms

But the deeper curse is political:

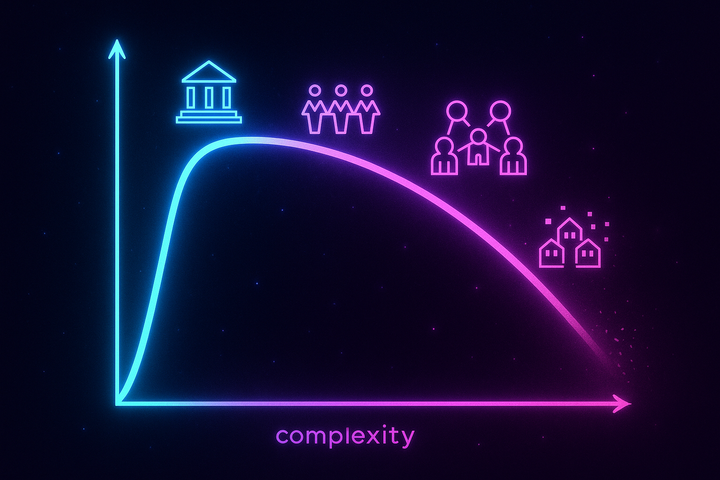

No taxation, no representation. Governments that fund themselves through resource revenue don't need taxes. Governments that don't need taxes don't need consent. The social contract that links citizen contribution to government accountability never develops.

Patronage becomes rational. When the state controls massive wealth that doesn't require productive citizens, political leaders buy loyalty rather than earn it. Patronage networks—distributing resource wealth to supporters—become the political system.

Opposition is starved. Without independent economic bases, opposition movements struggle to fund themselves. The resource-controlling state can outspend any challenger. Civil society remains weak because it lacks autonomous resources.

Repression is affordable. Security services are expensive. Resource-rich states can afford them. When dissent appears, it can be crushed. The same wealth that enables patronage enables police.

Foreign intervention increases. Resources attract outside powers. External actors support friendly regimes or rebel groups depending on their resource interests. The country becomes a battleground for foreign competition.

The result: political systems where power flows from resource control rather than popular legitimacy. Democracy becomes difficult not because of culture but because of material conditions.

This helps explain why the Arab world, sitting on enormous oil wealth, has been so resistant to democratization. It's not Islam—Muslim-majority countries without oil have democratized. It's not Arabs—Arab countries without oil have different politics. It's oil. The material conditions created by oil wealth make authoritarian governance the path of least resistance for rulers and difficult to challenge for citizens.

The Conflict Mechanisms

Resources also correlate with civil war:

Resources finance rebels. In countries with lootable resources—diamonds, coltan, timber, oil—rebels can fund themselves by controlling resource areas. Sierra Leone's diamond-funded conflict, Congo's mineral-driven wars, and Libya's oil-financed factions all follow this pattern.

Resources create targets. Concentrated resource wealth creates things worth fighting over. A country with dispersed agriculture offers no single prize. A country with oil fields does. Geography concentrates wealth; concentration creates conflict targets.

Grievances multiply. When resources are extracted from one region while wealth flows elsewhere, local populations have legitimate complaints. The Niger Delta violence reflects this: local communities bear environmental costs while Lagos and foreign companies capture benefits.

State weakness ironically increases. Resource-dependent states often have strong coercive capacity but weak administrative capacity. They can shoot but can't deliver services. This weakness creates opportunities for rebels while generating grievances that motivate them.

Geography of the Curse

The resource curse has geographic dimensions:

Concentration matters. Oil and minerals are concentrated by geology. Whoever controls the specific locations controls the wealth. Dispersed resources (farmland) create different politics than concentrated resources (oil fields).

Point-source versus diffuse. Economists distinguish point-source resources (oil, minerals) from diffuse resources (agriculture, forests). Point-source resources are easier to control, more amenable to rent capture, and more associated with authoritarian outcomes.

Location relative to borders. Resources near borders invite intervention. Resources in one ethnic region create separatist pressures. The geographic location of resources within countries shapes internal political geography.

Climate for alternatives. Countries with resources and no alternatives to resource extraction face worse outcomes than countries with resources and alternative development paths. Climate that supports agriculture provides an alternative; desert does not.

Escaping the Curse

Some countries have avoided or escaped resource curse dynamics:

Strong institutions first. Norway discovered oil in 1969, after centuries of democratic development. Its institutions could manage resource wealth. Countries that find resources before developing institutions face worse outcomes.

Stabilization funds. Sovereign wealth funds—like Norway's Government Pension Fund or Alaska's Permanent Fund—insulate spending from resource volatility. They convert depleting resources into permanent assets.

Diversification strategy. The United Arab Emirates, particularly Dubai, has deliberately diversified away from oil. It's not clear this would work without oil-funded initial investment, but the effort matters.

Transparency requirements. The Extractive Industries Transparency Initiative and similar efforts force disclosure of resource payments. Knowing who gets what money makes accountability more possible.

Direct distribution. Some economists propose distributing resource revenue directly to citizens, who would then be taxed—recreating the taxation-representation link. Alaska's dividend is a partial version. Full implementation remains rare.

None of these guarantees escape. The resource curse reflects deep structural dynamics that resist policy fixes. But it's not destiny—with the right institutions, resource wealth can be a blessing. The challenge is creating those institutions when resource wealth undermines the conditions for creating them.

The timing problem is acute: if you already have strong institutions when you find oil, you can manage it. If you don't, the oil makes creating institutions harder. This is why Botswana (diamonds discovered after independence with relatively good governance) fared better than Sierra Leone (diamonds funding civil war with weak state). Same resource type, different institutional sequence.

Beyond Oil

The resource curse framework extends to other concentrated resources:

Minerals. Copper, diamonds, coltan, rare earths—all create dynamics similar to oil. The DRC's mineral wealth has funded decades of conflict.

Water. As water becomes scarcer, countries controlling water sources may develop resource-curse dynamics. Dam construction gives upstream countries leverage that resembles oil power.

Data. Some analysts see parallels between resource extraction and data extraction. Concentrated control of valuable data—by tech companies or states—creates rent-seeking opportunities without productive activity.

Location itself. Singapore and Panama profit from geographic location (shipping lanes, canals). These "location rents" create dynamics different from commodity resources but with some parallels.

Carbon transition. As the world moves away from fossil fuels, oil states face the question of what comes after. Countries that have diversified will manage. Countries that haven't—Venezuela, Angola, many Gulf states—face potential collapse. The energy transition isn't just about climate; it's about the political economy of resource-dependent states.

The Takeaway

The resource curse shows that geographic endowment isn't simply good or bad—it shapes political possibilities in complex ways. Resources that seem like blessings often become curses, not through bad luck but through predictable mechanisms.

Countries with concentrated, valuable resources face specific challenges: Dutch Disease undermining other sectors, rent-seeking replacing productive activity, rulers who don't need citizens, and conflicts over control. These aren't failures of culture or leadership—they're structural outcomes of material conditions.

Understanding the curse matters for policy. Foreign aid that ignores resource dynamics may be wasted. Democracy promotion in resource states faces structural obstacles. Development strategy must account for how resources shape incentives.

It also matters for consumers. When we buy oil or minerals, we participate in systems that shape political outcomes in producer countries. Ethical consumption is complicated by these dynamics—there's no simple way to buy resources that doesn't affect the political economy of extraction.

The map distributes more than terrain. It distributes resources. And how resources are distributed shapes what political systems become possible.

The resource curse is one of the clearest examples of geographic determinism in the modern world. It's not ancient history or distant theory—it's happening now, affecting billions of people living in resource-rich countries with poor outcomes. Understanding it helps explain why good intentions and aid often fail, why some countries remain trapped while others develop, and why the simple equation "resources = wealth" is dangerously wrong.

Further Reading

- Ross, M. L. (2012). The Oil Curse: How Petroleum Wealth Shapes the Development of Nations. Princeton University Press. - Karl, T. L. (1997). The Paradox of Plenty: Oil Booms and Petro-States. University of California Press. - Collier, P. (2007). The Bottom Billion. Oxford University Press.

This is Part 6 of the Geography of Power series. Next: "Climate and Conflict: Drought Wars"

Comments ()