Transaction Costs: Why Firms Exist

If markets are so efficient, why do firms exist at all?

This was the question Ronald Coase asked in 1937, and Oliver Williamson spent his career answering. Williamson won the Nobel Prize in Economics in 2009 for work that seems almost tautological once you understand it: firms exist to reduce transaction costs.

But the implications are profound. The boundaries of organizations—what happens inside a company versus what happens through markets—aren't arbitrary. They're determined by the structure of transaction costs. Understanding those costs explains why some industries are dominated by giant corporations while others are populated by freelancers, why some activities are outsourced while others are kept in-house, and why the shape of economic organization changes over time.

The Coase Question

Ronald Coase noticed a puzzle that economists had overlooked.

Economic theory said that markets coordinate activity efficiently. The price mechanism signals where resources are needed, and resources flow to their highest-valued uses. Beautiful.

But inside a firm, there's no price mechanism. Employees don't bargain with each other for every task. Managers don't auction off assignments. The firm operates through hierarchy and direction, not market exchange.

If markets are so great, why doesn't everyone just contract with everyone else? Why do we have these islands of planned coordination (firms) in the sea of the market?

Coase's answer: because using markets is costly.

Every market transaction involves costs beyond the price paid. Finding a trading partner. Negotiating terms. Writing a contract. Monitoring compliance. Enforcing the agreement. These "transaction costs" are the friction in the market mechanism.

Firms exist because sometimes it's cheaper to coordinate activity through hierarchy than through market exchange. The boundary of the firm is where the cost of internal coordination equals the cost of market coordination.

Williamson's Framework

Oliver Williamson took Coase's insight and systematized it. He identified the key factors that make transaction costs high or low:

Asset specificity: How specialized are the assets involved in the transaction?

If assets are general-purpose (a standard truck, a common software skill), market transactions are easy. You can find alternative suppliers or buyers. Neither party is locked in.

If assets are highly specific—designed for this particular relationship, with little value outside it—the parties become mutually dependent. Switching is costly. This creates "hold-up" problems: either party can threaten to exit, extracting concessions from the other.

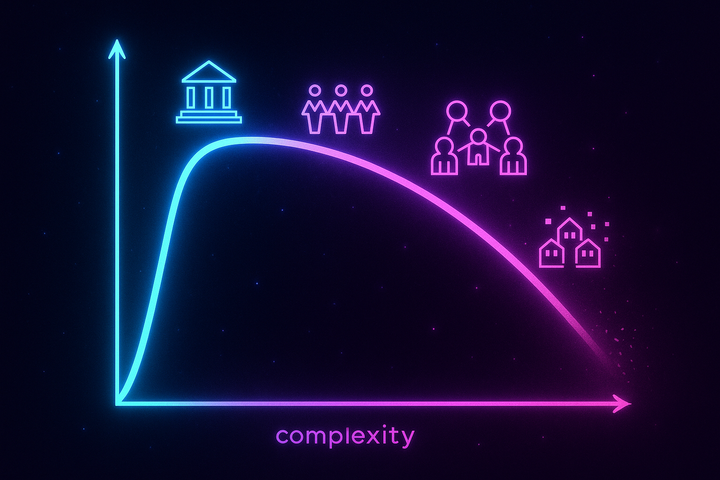

Uncertainty: How hard is it to specify and verify what's being transacted?

Simple, observable transactions can be contracted easily. Complex, hard-to-measure activities are difficult to write contracts for. If you can't specify what you're buying, or verify whether you got it, market exchange becomes risky.

Frequency: How often does the transaction occur?

One-time transactions favor markets—you don't need ongoing relationships. Repeated transactions favor integration—the costs of setting up internal coordination can be amortized over many interactions.

High asset specificity + high uncertainty + high frequency = bring it inside the firm.

Low asset specificity + low uncertainty + low frequency = leave it to the market.

The Hold-Up Problem

Asset specificity deserves special attention because it's the engine of organizational form.

Consider building a factory next to a mine. The factory is designed to process ore from that specific mine. Once built, the factory has little value if the mine stops supplying ore. And the mine has little value if the factory stops buying ore.

Both parties are locked in. And both know it.

This creates incentives for opportunism. The mine owner can threaten to raise prices, knowing the factory can't easily switch suppliers. The factory owner can threaten to squeeze prices, knowing the mine can't easily find another buyer. Each party tries to extract rents from the other's locked-in position.

The result is wasteful negotiation, underinvestment (you don't invest in specific assets if you expect to be held up), and relationship breakdown.

Vertical integration solves the hold-up problem. If the mine and factory are owned by the same company, there's no bargaining over internal transfers. The organization captures the full value of specific investments without the risk of opportunism.

This explains industrial organization patterns:

- Aluminum smelters are often co-located with and co-owned by bauxite mines—the smelter is highly specific to the ore source. - GM famously bought Fisher Body after contract disputes over specialized car body dies. - Companies integrate backward into suppliers when supply relationships require specific investments.

The pattern is general: where transactions require relationship-specific investments, you'll find vertical integration or other mechanisms to govern the relationship beyond simple market exchange.

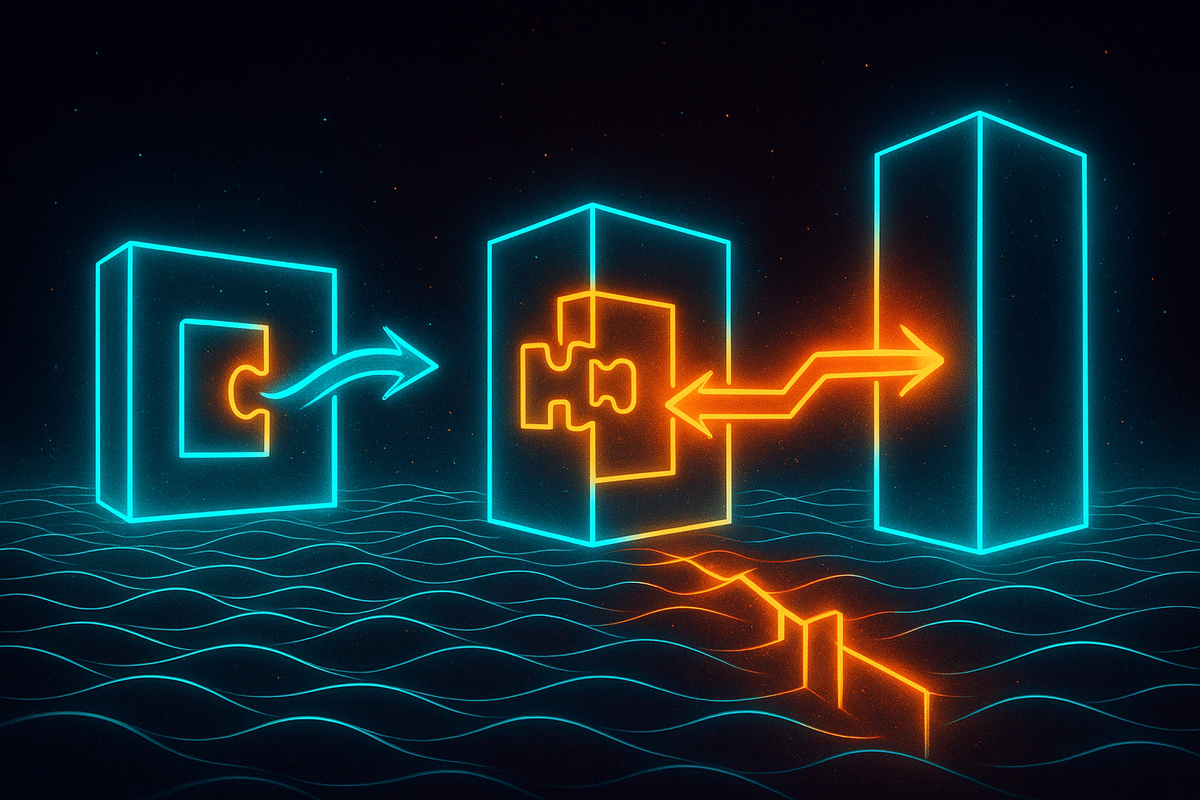

Hybrid Forms

The choice isn't just market vs. hierarchy. Williamson recognized intermediate forms.

Long-term contracts can govern relationships with moderate asset specificity. You agree to terms that protect both parties' investments, with provisions for renegotiation as circumstances change.

Franchising splits the difference: the franchisee owns local assets, the franchisor owns the brand and system. The relationship involves specific investments by both parties, governed by detailed contracts rather than integration.

Joint ventures allow firms to make relationship-specific investments together without full integration.

Relational contracts—agreements that rely more on trust and reputation than on legal enforcement—govern many transactions where formal contracting is too costly.

These hybrid forms emerge where pure market or pure hierarchy doesn't fit. They require governance structures—ways of managing the relationship, resolving disputes, adapting to change—that are tailored to the specific transaction characteristics.

Why This Matters for Trust

Williamson's framework connects to trust in a crucial way.

Transaction costs are partly trust costs. When you don't trust a trading partner, you need costly safeguards. You write detailed contracts. You monitor performance closely. You keep assets non-specific so you can exit. These are transaction costs.

High-trust relationships reduce transaction costs. If you trust a supplier, you don't need elaborate contracts. If you trust an employee, you don't need constant monitoring. Trust substitutes for formal governance.

But trust is also produced by governance. Good contracts, clear property rights, reliable enforcement—these create environments where trust can develop. You don't start with trust; you build it through repeated interactions under institutional constraints that make betrayal costly.

The relationship is circular: trust reduces transaction costs, and institutions that reduce transaction costs enable trust.

This explains why the same transaction might be governed differently in different societies:

- In high-trust societies, informal relational contracts work. - In low-trust societies, you need formal safeguards—or vertical integration.

The "correct" organizational form depends on the ambient trust level. Japanese keiretsu networks rely on trust that wouldn't exist in other contexts. American firms often integrate functions that Japanese firms leave to market relationships.

The Digital Transformation

Williamson's framework helps explain how digitization is reshaping organizations.

Information technology reduces transaction costs. Search is cheaper (you can find suppliers globally). Monitoring is easier (you can track performance digitally). Coordination is simpler (remote collaboration is feasible).

When transaction costs fall, the efficient boundary of the firm shrinks. Activities that were once brought inside—because market coordination was too costly—can now be outsourced.

This explains several trends:

- The rise of outsourcing and global supply chains - The gig economy (contracting for work that was once employment) - Platform businesses that coordinate market activity without hierarchy - The decline of vertically integrated conglomerates

But digitization doesn't eliminate transaction costs. It shifts them. Some assets remain highly specific—proprietary algorithms, organizational culture, tacit knowledge. Some activities remain hard to contract for—innovation, judgment, creativity.

The firms that survive are those that still solve transaction cost problems that markets can't. The question for any organization is: what transaction costs justify our existence? What would happen if we tried to do this through the market instead?

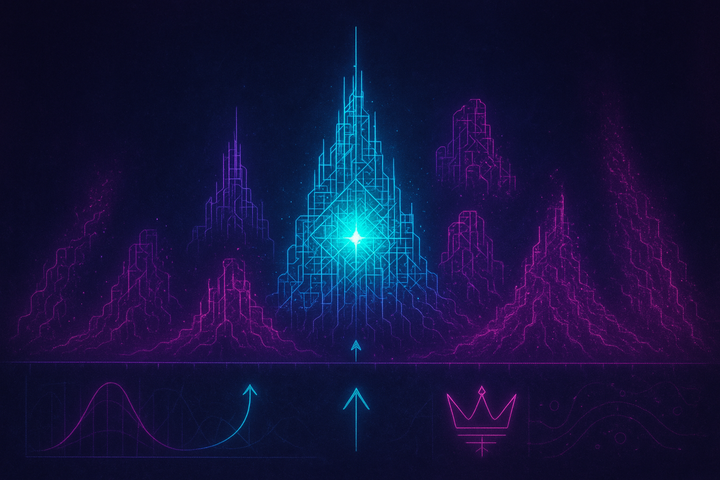

The Dark Side: Transaction Costs as Moats

There's a less savory interpretation of transaction costs: sometimes organizations create them deliberately.

If transaction costs determine organizational boundaries, then raising transaction costs can protect those boundaries. Firms can deliberately make switching costly—lock-in contracts, proprietary standards, learning curves. These are transaction costs engineered for competitive advantage.

Platform businesses understand this intimately. Once you're on a platform, leaving is costly—your data, your network, your learned behaviors are all platform-specific. The platform didn't necessarily intend to create lock-in (though some do), but the asset specificity emerged anyway.

This is why antitrust economists increasingly focus on switching costs and lock-in. The question isn't just whether prices are high—it's whether transaction costs prevent competition from functioning.

The Employment Relationship

The employment relationship is a special case that illuminates the whole framework.

Why do firms employ people rather than contracting for each task?

Williamson's answer: employment makes sense when the employee will develop firm-specific human capital—skills, relationships, and knowledge that are valuable at this firm but not elsewhere. If you contracted for each task, the employee wouldn't invest in firm-specific skills (why bother, if you might not be hired tomorrow?). The firm wouldn't invest in training (why train someone who might leave?).

Employment solves this by creating a long-term relationship with mutual investment. The employee develops firm-specific skills. The firm provides job security and internal advancement. Both become locked in—but productively so.

This explains the classic observation that "core" activities tend to be done by employees while "peripheral" activities tend to be contracted out. Core activities require specific human capital; peripheral activities don't.

It also explains why the gig economy is controversial. Gig work eliminates the mutual investment of employment. Workers don't develop firm-specific capital. Companies don't invest in worker development. The relationship is purely transactional—which is efficient for some tasks and destructive for others.

Organizational Economics

Williamson's framework became the foundation of organizational economics—the study of how organizations are structured and why.

Key insights from this tradition:

Boundaries are strategic. Deciding what to make vs. buy, what to integrate vs. outsource—these are fundamental strategic choices. They determine what capabilities you develop, what relationships you depend on, what risks you bear.

Governance matters as much as technology. Two firms with the same technology can perform very differently depending on how they're organized. The governance structure determines whether information flows, whether incentives align, whether adaptation happens.

One size doesn't fit all. The optimal organization depends on the characteristics of the transactions it needs to govern. There's no universal best practice—just fit between organizational form and transaction properties.

Organizations are responses to problems. Firms aren't natural entities. They're solutions to coordination problems. When the problems change (technology shifts, markets evolve, trust conditions change), the solutions should change too. But organizations often persist past their problem.

The Takeaway

Firms exist because markets are costly. Transaction costs—the friction of market exchange—determine what happens inside organizations versus what happens through markets.

Asset specificity is the key driver. When investments are relationship-specific, market exchange creates hold-up problems. Integration, long-term contracts, or other governance structures emerge to protect those investments.

The boundary of the firm isn't arbitrary—it's optimal given the transaction costs involved. As technology and trust change, so do the efficient boundaries of organizations.

Understanding this framework lets you see organizations not as given entities but as evolved solutions to coordination problems. The question isn't "how should we organize?" It's "what transaction cost problems are we solving, and is our current structure still the best solution?"

Further Reading

- Williamson, O. E. (1985). The Economic Institutions of Capitalism. Free Press. - Coase, R. H. (1937). "The nature of the firm." Economica. - Klein, B., Crawford, R. G., & Alchian, A. A. (1978). "Vertical integration, appropriable rents, and the competitive contracting process." Journal of Law and Economics.

This is Part 3 of the Economics of Trust series. Next: "Elinor Ostrom: Governing the Commons"

Comments ()