Wisdom of Crowds: Surowiecki's Conditions

In 2003, the Defense Advanced Research Projects Agency (DARPA) proposed something that seemed insane: a futures market for terrorism. You could bet real money on the likelihood of assassinations, coups, and attacks. The idea was that such a market would aggregate intelligence better than any CIA analysis.

The backlash was immediate and bipartisan. Senators called it "morally repugnant." The program was killed within 24 hours of the press coverage. The researcher behind it quietly resigned.

Here's the thing: the underlying science was sound. Markets are remarkably good at aggregating dispersed information. The problem was political—people were disgusted by the idea of profiting from terrorism predictions.

But the failure illustrates something important about collective intelligence: it works, but implementing it runs into human nature. James Surowiecki's The Wisdom of Crowds became a bestseller by explaining when and why crowds are wise. What he couldn't solve was how to actually deploy that wisdom in a world full of politics, emotions, and moral intuitions.

The Four Pillars

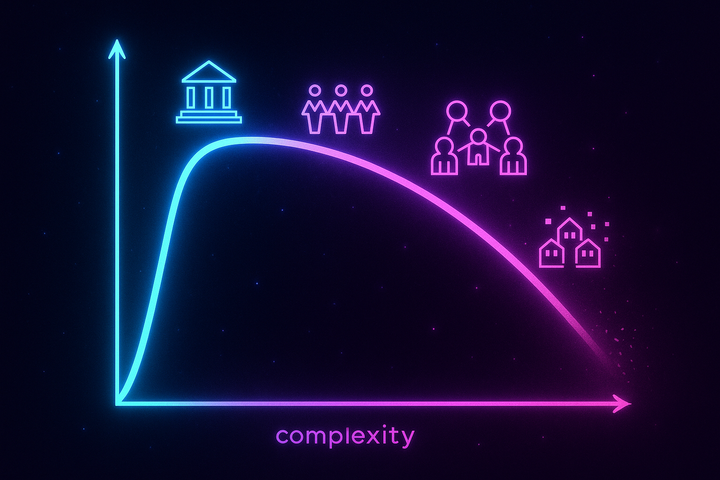

Surowiecki identified four conditions necessary for collective wisdom. When all four hold, groups reliably outperform individuals. When any fails, groups become mobs.

Diversity of Opinion

Every person needs to bring something different to the table—even if it's wrong.

This is counterintuitive. We think the best decisions come from the best people. Find the experts, give them power, let them decide. But expertise comes with blind spots. Experts share training, assumptions, mental models. They're wrong in correlated ways.

Diversity doesn't mean including ignorant people because ignorance is valuable. It means including people whose errors are uncorrelated with everyone else's errors. When errors are random and independent, they cancel out under aggregation. When errors are correlated, they compound.

The math is unforgiving. If you poll 1,000 people who all read the same newspaper, have the same training, and share the same biases, you don't get 1,000 independent data points. You get one data point, measured 1,000 times. The diversity that matters is cognitive diversity—different ways of thinking about the problem.

This is why the best forecasting teams mix economists with historians, data scientists with journalists, young people with old people. It's not affirmative action. It's error cancellation.

The corporate world systematically undermines this. Hiring for "culture fit" often means hiring people who think alike. Elite firms recruit from the same universities, using the same criteria. The result is rooms full of smart people who all have the same blind spots. High individual competence, low collective intelligence.

Independence

People must form their own judgments without being influenced by others.

This is the condition that fails most catastrophically in real-world settings. Humans are social animals. We watch each other. We defer to perceived experts. We adjust our views to match our in-group.

The moment people start copying each other, diversity collapses. You no longer have many independent judgments—you have one judgment, replicated. The crowd stops being wise and starts being a herd.

Information cascades are the formal mechanism. Imagine a sequence of people guessing whether an urn contains mostly red balls or mostly blue balls. The first person draws a ball, sees it's red, and guesses "mostly red." The second person draws blue but figures the first person must have known something—so they also guess red. The third person sees two "red" guesses and concludes the evidence favors red, regardless of their own draw. Soon everyone is guessing red, even if most people drew blue balls.

The cascade locks in on potentially wrong answers because later observers rationally ignore their private information. Independence is destroyed not by force but by inference.

This is why prediction markets need to prevent people from seeing others' bets until they've placed their own. Why survey design carefully avoids leading questions. Why scientific peer review is (supposed to be) blind. The infrastructure of independence is as important as the diversity of participants.

Decentralization

People should be able to specialize and draw on local knowledge.

Central planners can't know everything. The whole point of collective intelligence is that knowledge is distributed—different people know different things. Decentralization lets them use what they know.

This was Hayek's central insight about markets. No central planner could ever know the local supply and demand conditions in every market. But prices aggregate that dispersed knowledge automatically. The baker doesn't need to know global wheat production; they just need to see the price of flour. The information is encoded in the system.

Decentralization isn't just about structure—it's about epistemic humility. The moment someone at the center decides they know better than the distributed nodes, collective intelligence degrades. Central control might be necessary for coordination, but it comes at a cost: the loss of local information that the center can't access.

The worst combination is a system that's structurally decentralized but epistemically centralized—where people in different locations all defer to the same source. Social media often produces this: geographically dispersed users who all get their views from the same viral posts. You get the costs of decentralization (coordination problems) without the benefits (diverse local knowledge).

Aggregation

There must be some mechanism for turning individual judgments into a collective answer.

This sounds obvious, but the mechanism matters enormously.

Averaging works well for estimation problems—guess the weight, estimate the number, predict the outcome. Errors cancel; the central tendency emerges. But averaging works poorly when the answer isn't a quantity but a choice. You can't average between Option A and Option B.

Voting works well for binary choices, especially when each voter has some probability of being right. But voting destroys information about intensity—someone who's 51% confident counts the same as someone who's 99% confident. And voting can suppress minority views that might be right.

Markets solve the intensity problem by making people put money behind their beliefs. Someone more confident bets more; their view gets proportionally more weight. But markets require liquidity, can be manipulated by large players, and don't work well for questions that can't be easily settled.

Deliberation lets people share information and update their views. In theory, it improves on simple aggregation by allowing argument and evidence to spread. In practice, deliberation often destroys independence—early speakers anchor the discussion, high-status participants dominate, and groups converge prematurely on socially comfortable conclusions.

The aggregation mechanism shapes what kind of intelligence you can extract. If you want to estimate a quantity, average. If you want to select among discrete options, vote (but consider intensity-weighted methods). If you want continuous updating with confidence weighting, use markets. Choosing the wrong mechanism is like using a hammer to measure temperature—the tool doesn't match the task.

The best systems combine mechanisms. Collect initial judgments independently (preserving diversity and independence). Allow structured deliberation to share information (enabling learning). Aggregate final judgments through an appropriate mechanism (voting, averaging, market). No single method works for everything.

The Conditions in Practice

When It Works: Prediction Markets

Prediction markets come closest to satisfying all four conditions simultaneously.

Diversity: Anyone with money can participate. Backgrounds, expertise levels, and perspectives vary widely.

Independence: Bets are placed individually, often without seeing others' positions until you've committed.

Decentralization: Traders act on their own information—local knowledge, specialist expertise, contrarian hunches.

Aggregation: Prices continuously update to reflect the balance of money-weighted opinion. More confident traders bet more; prices move toward informed consensus.

The Iowa Electronic Markets have outperformed polls in predicting election outcomes. Internal prediction markets at companies like Google and HP have outperformed traditional forecasting. Sports betting lines are remarkably accurate—Vegas knows.

The mechanism works. The question is why we don't use it more.

The answer is partly technical (legal restrictions on gambling, liquidity requirements, manipulation concerns) and partly cultural (people are uncomfortable with the idea that markets know more than experts, that betting produces better forecasts than committees).

There's also an accountability problem. If a committee makes a bad decision, you can blame the committee members. If a market makes a bad prediction, who do you fire? The distributed nature of collective intelligence makes it hard to assign responsibility—which is uncomfortable for organizations built around individual accountability.

When It Fails: Stock Market Bubbles

The same stock market that efficiently prices most assets most of the time also produces spectacular bubbles and crashes. What goes wrong?

Independence fails first. During bubbles, investors stop making independent judgments. They watch what others are buying. They infer that rising prices mean others know something. They buy because others are buying.

Diversity collapses second. Contrarians—the people who would normally provide error-correcting alternative views—get driven out. If you shorted tech stocks in 1999, you went bankrupt before the market proved you right. Selection pressure removes diversity precisely when it's most needed.

Aggregation becomes self-referential. Prices stop reflecting fundamentals and start reflecting expectations about other people's expectations. The market becomes a beauty contest—you're not picking the most beautiful face, you're picking the face you think others will find most beautiful.

The bubble doesn't mean markets are useless. It means the conditions for collective intelligence are fragile. When they hold, markets are wise. When they fail, markets are manic.

The Deeper Lesson

Surowiecki's framework isn't just about prediction accuracy. It's about the conditions under which groups can think at all.

Most human institutions are designed to suppress collective intelligence. Hierarchies concentrate decision-making in leaders who may be less informed than the people below them. Meetings let dominant personalities anchor discussion while shy people stay silent. Credentials filter for people with similar training who share similar blind spots.

We do this for good reasons—coordination, accountability, efficiency. But we pay a cognitive cost. Every institution that centralizes judgment is trading off collective intelligence for something else.

The question isn't whether to have hierarchy or decentralization. It's whether you understand the trade-off you're making. And whether you've designed mechanisms that preserve collective intelligence where it matters most.

Some decisions genuinely require central coordination—you can't run an army by vote. But many decisions currently made by executives or committees would be better made by properly structured aggregation of distributed judgment.

The technology exists. Prediction markets, structured estimation protocols, ensemble forecasting methods—we know how to do this. The barriers are cultural and political. People with authority don't want to be told that a market knows better than they do. Experts don't want to be averaged with amateurs. The infrastructure of collective intelligence threatens existing power structures.

Surowiecki's conditions aren't just scientific findings. They're design criteria for institutions that could be smarter than any individual—and a challenge to institutions that aren't.

The Takeaway

Collective intelligence requires four conditions: diversity of opinion, independence of judgment, decentralization of knowledge, and proper aggregation mechanisms. When all four hold, groups outperform individuals. When any fails, groups become mobs.

The conditions are fragile. Social pressure destroys independence. Credentialing destroys diversity. Centralization destroys local knowledge. Bad aggregation mechanisms lose information.

The conditions are engineerable. We know how to structure environments that preserve diversity, enforce independence, enable decentralization, and aggregate properly. The question is whether we have the will to implement them—and the humility to trust the results.

Surowiecki gave us the framework. Implementing it is still mostly ahead of us.

Further Reading

- Surowiecki, J. (2004). The Wisdom of Crowds. Doubleday. - Hayek, F. A. (1945). "The Use of Knowledge in Society." American Economic Review. - Arrow, K. J., et al. (2008). "The Promise of Prediction Markets." Science.

This is Part 2 of the Collective Intelligence series. Next: "Prediction Markets"

Comments ()